According to 3D Science Valley’s market research, most companies have invested less than 10 million yuan (1.3 million EUR, Ed.) in AM R&D in 2020. Furthermore, the Chinese domestic R&D investment in Additive Manufacturing in 2020 shows a 30%-40% increase compared to 2019. In addition, R&D investment in the fields of composite materials, process control, and artificial intelligence has begun to show at an accelerated trend, which has diversified changes from the previous focus on equipment development. In the following are trends of some typical R&D achievements in the Chinese market:

Trend 1: PBF equipment is moving towards multi-laser and large size

Since 2016, company BLT began to develop equipment with a unidirectional forming size of 500 mm or more. BLT has successively introduced key technologies such as four beam scanning. The company has continued to cultivate intelligent software for process quality control. Since March 2020, BLT has successively introduced machines BLT-S450 and BLT-S600 with multiple R&D iterations and test runs measuring in the tens of thousands of hours. In 2020, BLT also established a South China application R&D center in Shenzhen to drive further adoption of their technology with local application support. EPLUS3D’s EP-M650 four-laser equipment successfully passed the molding test of IN718 material for high temperature parts. YN LASER has developed and manufactured super-large LB-PBF equipment with a build plate size of 1000 mm in diameter and a building height of 850 mm.

Trend 2: Diversified processing technology extended based on each player’s core strength

NANJING TITANIUM INTELLIGENT SYSTEM has developed a plasma generator with a plasma arc nozzle and three-dimensional printing equipment including a practical control system. A stable and controllable flow field is obtained outside of the nozzle and a wide material range is available. BEIJING NATIONAL INNOVATION INSTITUTE OF LIGHTWEIGHT has developed a continuous fiber Additive Manufacturing method with Z-direction reinforcement. Continuous fibers are introduced into the Z-direction of the composite material component to improve or enhance the interlayer performance of the formed composite material component, hence the internal fiber structure of the composite material is complicated and diversified. In terms of sand mold 3D printing, the KOCEL GROUP has developed a print head protection device, a print head cleaning method, and a 3D printer that can avoid secondary pollution and friction problems on the print head, which can greatly increase the life of the print head and reduce the overall cost of production.

Trend 3: Materials to be more diversified

Many Chinese domestic companies and universities are studying ceramic reinforced metal composite materials. Among them, the ceramic reinforced aluminum alloy powder jointly developed and produced by ANHUI XIANGBANG COMPOSITES and SHANGHAI JIAOTONG UNIVERSITY can improve powder fluidity, increase laser absorption rate, and refine grain structure. It is especially suitable for 3D printing and is suitable for large-scale production applications.

JIANGSU UNIVERSITY has developed a graphene ceramic composite material by using a combination of 3D printing technology and microwave pressure sintering. After sintering, alumina and silicon carbide form a nano-ceramic composite material. The prepared composite materials have good fracture toughness, electrical and thermal conductivity. This method greatly reduces production costs and has good economic benefits.

NORTHWESTERN POLYTECHNICAL UNIVERSITY has developed 3D printing alumina ceramics. A photocurable 3D printed polysiloxane ceramic precursor is introduced into the alumina powder material. The density of the ceramics after sintering can reach 99%.

LIAONING GUANDA NEW MATERIAL TECHNOLOGY developed ultra-low oxygen cobalt-based deformed superalloy powder GH5188. This powder can ensure the content of lanthanum. At the same time, the metal powder has the advantages of high sphericity, good fluidity, and narrow particle size distribution.

There are other companies that are active in the field of materials research and development, including ANHUI CNPC POWER, SICHUAN XINDA GROUP, XI’AN SINO-EURO MATERIALS TECHNOLOGIES.

Trend 4: Full chain process solutions and artificial intelligence

One of the major obstacles to the use of 3D printing in upgrading the manufacturing industry is that the current digital chain is too fragmented. HEYGEARS has developed in-depth development of the full-process orthodontic solution in 2020, integrating the full-chain production process of invisible aligners. The fully automated 3D printing process of processing, automatic production, and automatic cutting realizes automatic 24-hour continuous production.

I believe that in the field of additive manufacturing, any software-driven technology that does not use AI will sooner or later be replaced. AI is the core of all different levels of competitiveness.

The professional process simulation software AMProSim-DED for metal additive manufacturing Directed Energy Deposition process jointly developed by PERA ADDITIVE and ZHONGKE YUCHEN can simulate in detail the effect of the phase change process of the part partition, the printing path as well as the melting and cooling in the AM process. The software can predict the temperature, stress and deformation in the AM process, optimize the process parameters, so as to ensure the 3D printing quality and printing efficiency, and avoid the inefficient trial and error process. In addition, PERA ADDITIVES has also developed the APRO control system to realize the control of continuous automated production.

ZHEJIANG UNIVERSITY has developed a machine learning-based method for predicting the thermal history of multilayer arc additive manufacturing processes. ZHEJIANG UNIVERSITY uses an integrated learning model based on multiple base learners based on two-way long and short-term memory networks to fit the unit set activation sequence. The prediction accuracy is high, the prediction speed is fast, and the memory usage is small.

Trend 5: Incubating new technologies in universities becomes one of the innovation drivers

SHENZHEN UPRISE 3D TECHNOLOGY a spin-of from CENTRAL SOUTH UNIVERSITY, is bringing a complete set of metal/ceramic indirect 3D printing solutions from printing materials, 3D printers, operating software to debinding and sintering furnaces to the market. Apart from that, its large-size independent dual-nozzle 3D printer realizes composite printing of two different materials (metal and metal, metal and ceramic, ceramic and ceramic).

According to the market survey of 3D SCIENCE VALLEY, there are still many universities active in the field of 3D printing research and development, including: NANJING UNIVERSITY OF AERONAUTICS AND ASTRONAUTICS, TSINGHUA UNIVERSITY, HUAZHONG UNIVERSITY OF SCIENCE AND TECHNOLOGY, SHANGHAI JIAOTONG UNIVERSITY, XI’AN JIAOTONG UNIVERSITY, ZHEJIANG UNIVERSITY, ZHEJIANG UNIVERSITY OF TECHNOLOGY, NORTHWESTERN POLYTECHNICAL UNIVERSITY, JIANGSU UNIVERSITY OF SCIENCE AND TECHNOLOGY, MARINE EQUIPMENT RESEARCH INSTITUTE OF JIANGSU UNIVERSITY OF SCIENCE AND TECHNOLOGY, NANJING UNIVERSITY OF SCIENCE AND TECHNOLOGY, HARBIN UNIVERSITY OF SCIENCE AND TECHNOLOGY, etc.

Trend 6: Traditional manufacturers enter the 3D printing field

GUANGDONG YIZUMI developed their so called spaceA system – screw extrusion type Additive Manufacturing. As AM is going to enter to a new era of AM 2.0 (characterized by digital inventory, used for production), more and more cross-industry companies like YIZUMI will enter the 3D printing field and together drive the development.

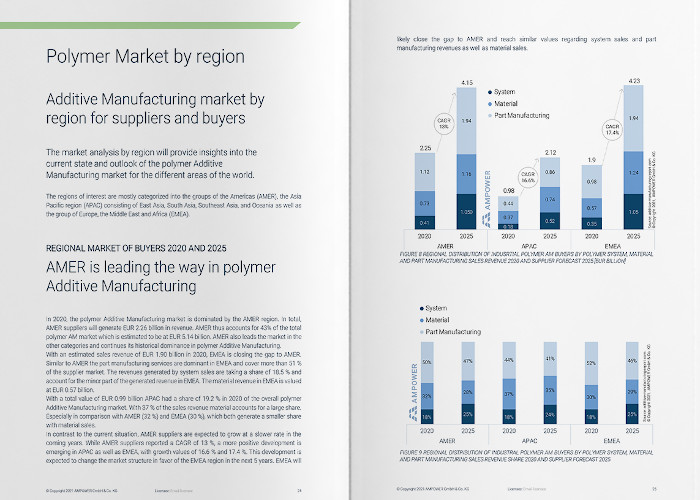

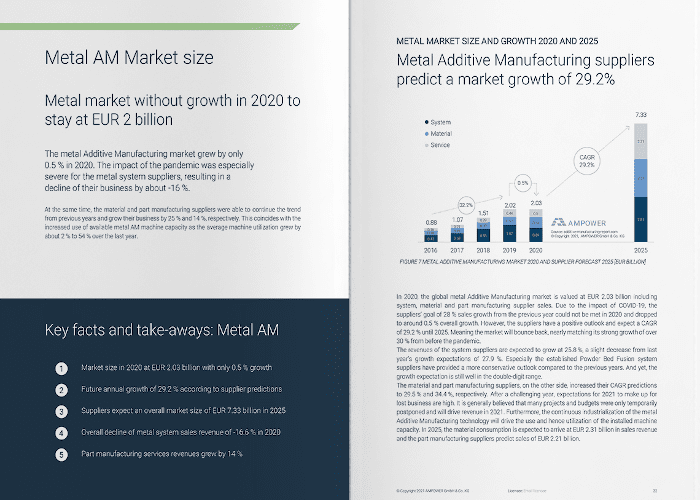

AMPOWER GmbH & Co. KG.

AMPOWER GmbH & Co. KG.