Metal AM market by technology 2024

15. March 2024 in 2024, Metal Market /by Maximilian MunschMetal Additive Manufacturing market by technology

Sales segmented by technology

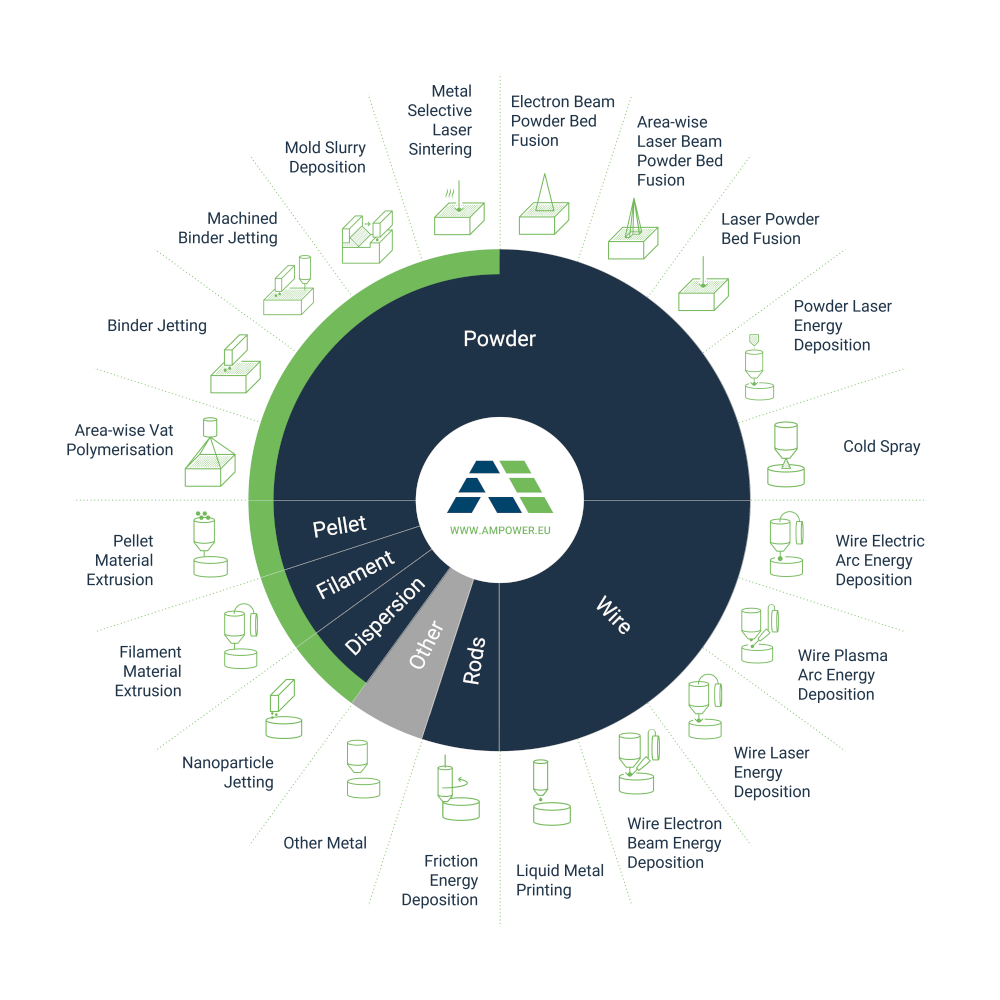

The following sections segments the unit sales and revenue by the main metal AM technologies. Powder Bed Fusion is today by far the leading the technology with most sales and system vendors worldwide. However, other technologies catch up and become an viable alternative for users future production facilities of series parts.

What you will find in this report section

You are not logged in or you do not have a subscription to the AMPOWER Report 2024.

To access the full report content please login or purchase a plan.

Click here for a market report summary.