Polymer AM

Equipment manufacturers polymer 3D printing

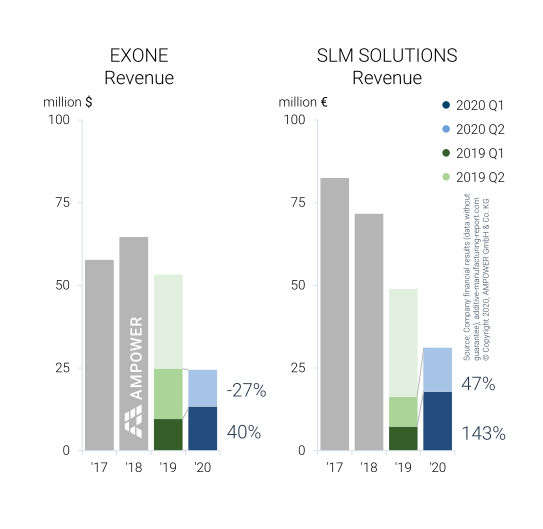

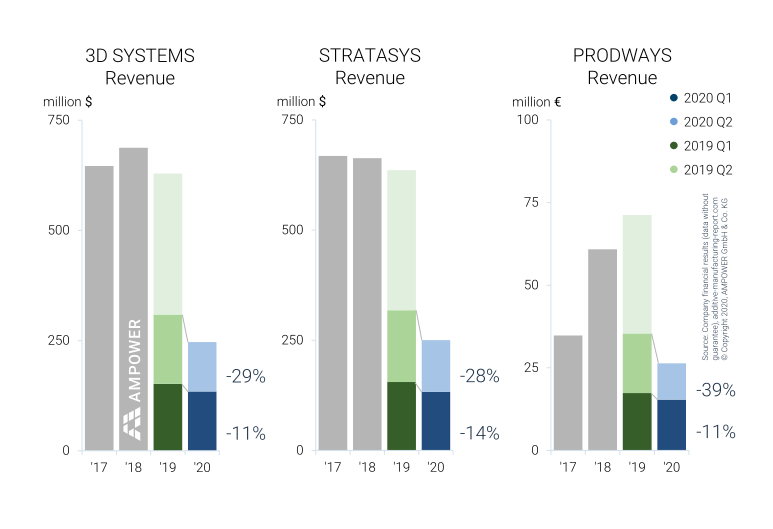

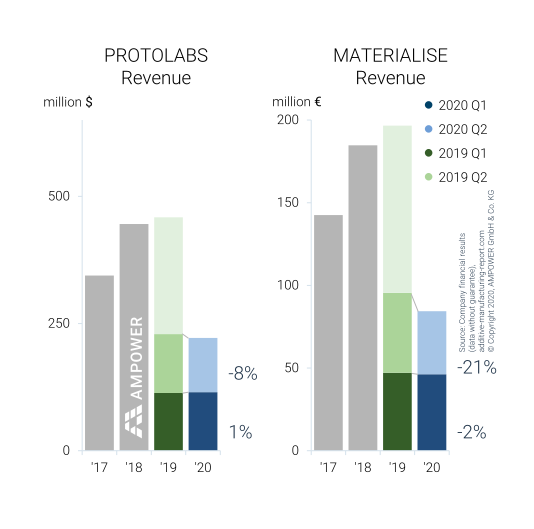

The equipment manufacturer 3D SYSTEMS, active in the polymer and metal sector, already suffered a decline in sales of -9 % from 2018 to 2019. In the first two quarters of this year, again reduced revenue was reported. In the second quarter of 2020, revenue fell by -29 % compared to the previous year. This slump is attributable in particular to lower printer sales, which fell by -43 % year-on-year. The lower sales of -30 % in the area of materials also indicate lower capacity utilization of printers by customers.

The system manufacturer STRATASYS, currently almost exclusively offering polymer machines and services on the market, presents a similar picture. Declining annual sales have been observed since 2017. Compared to the previous year, revenue in the second quarter of 2020 was down by -28 %. While services were down by -17 %, the decline was particularly noticeable in sold printers and consumables, which fell by more than -30 %.

PRODWAYS, on the other hand, has shown positive growth in the double-digit range in recent years with its polymer systems and other activities. However, revenue in the second quarter of 2020 was also down -39 % on the previous year, following an -11 % decline in Q1.

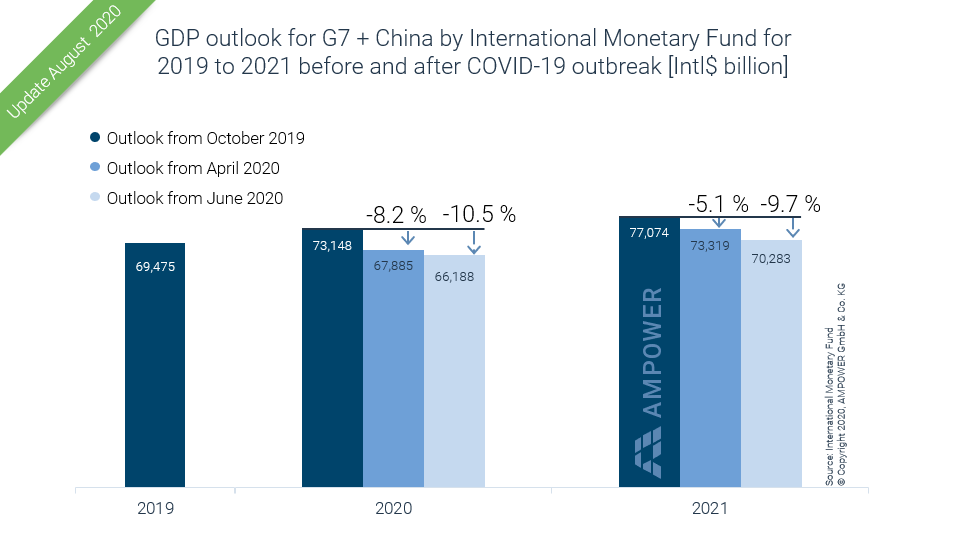

AMPOWER attributes the general decline in sales of established equipment manufacturers in recent years primarily to the increasing competitive pressure in the machine market. In the polymer machine market, the entry of HP and others has led to major shifts. In the metal system sector, the push of the Binder Jetting technology and the steadily increasing number of equipment manufacturers of Powder Bed Fusion technology has led to an oversupply of AM machines. A quick recovery of system sales in the polymer and metal market is not expected by AMPOWER due to the overall economic forecast. Rather, an accelerated consolidation of the numerous system manufacturers is inevitable in the following years.

![Metal Additive Manufacturing market 2019 and supplier forecast 2020, 2021 considering COVID-19 scenarios [EUR billion] Update August 2020](https://additive-manufacturing-report.com/wp-content/uploads/2020/05/Metal-Additive-Manufacturing-market-2019-and-supplier-forecast-2020-2021-considering-COVID-19-scenarios-EUR-billion-Update-August-2020.png)