Additive Manufacturing continued to prove its relevance in the Oceania region in 2020, with the global pandemic highlighting a number of supply chain issues that adversely affect with ability of Australia and New Zealand to provide critical supplies in a number of different industries. The Australian government in particular has shown support for manufacturing by committing extra funds towards programs that support collaboration between business and research, and by taking a more proactive approach in setting policy to support domestic manufacturing. Research in Australia continues to be comparatively cheap to conduct owing to favourable exchange rates and attractive R&D incentives through funding bodies.

Defence and space, medical, and resources, are becoming the predominant industries that utilise Additive Manufacturing, and this is where the majority of the AM activity is occurring. New programs such as the Hunter Class frigate are prime possibilities for the inclusion of Additive Manufacturing technologies. In addition to that, sustainment programs are growing their use of AM for spares and repairs. Publicly listed companies such AMAERO INTERNATIONAL and AML3D are proactively working with primes such as BAE SYSTEMS, ASC SHIPBUILDING, and AUSTAL, to name a few, to investigate where AM can be best utilised. A different but promising approach is being taken by SPEE3D, a company that have developed machines based on Cold Spray technology, by putting their machines in field trials to print parts on demand on the front line. This has led to sales to the Navy and the Special Forces, with a hope that the US and Europe will follow suit.

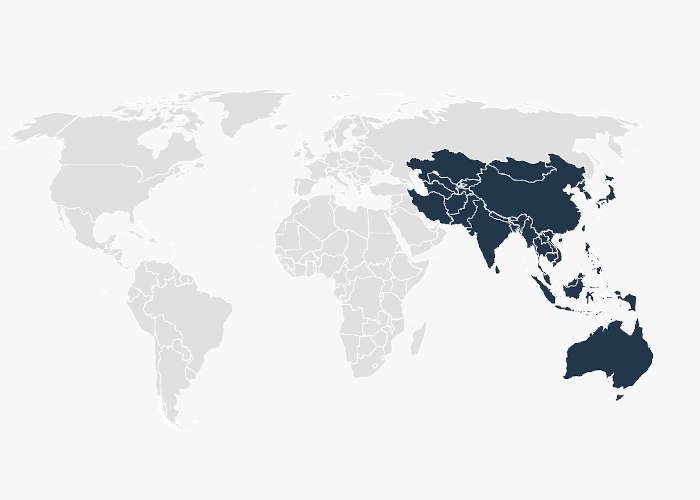

Many companies are forging strong international links by establishing satellite offices and subsidiaries in global locations. AML3D has established an office in Singapore, AMAREO INTERNATIONAL has established a facility in the US, and SPEE3D now has a presence in the US and Europe. For AM to really take off in this region it is clear that businesses must be globally focused. The reverse trend is true for GOPROTO, a Californian based business that has established a subsidiary in Melbourne. Recent Australian acquisitions of a service bureau and a scanning/reverse engineering business, in addition to their own facility, have seen the business expand rapidly in short period of time.

Medical 3D printing continues to have a strong presence in Australia and New Zealand, both in R&D and in industry. Melbourne-based 3D printing company 3DMEDITECH was very quick to respond to the global pandemic by designing, printing and testing nasopharyngeal swabs for COVID-19. 3DMEDITECH are also supporting the development of ventilators made by GEKKO MEDICAL with 3D printing of various parts. 3DMEDITECH ordinarily make dental aligners and baby helmets, but were able to use their in-house design expertise, and their 3D printing facility to quickly pivot to swabs and ventilator parts.

The STRYKER medical research project with RMIT University, University of Sydney, St Vincent’s Hospital, and the Innovative Manufacturing Cooperative Research Centre has catalysed more than AU$12 million dollars (7.6 million EUR, Ed.) of research effort developing intellectual property for patient-specific implants. This project is a one-of-a-kind approach focused on commercialisation of the unique lattice designs enabled by AM that have been developed at RMIT. The project will lead to direct opportunities for Australian businesses to become medical suppliers to STRYKER, and will cement Australia’s place as lead innovators in medical AM.