Author Archive for: Adm@amp_01

About Adm@amp_01

This author has yet to write their bio.Meanwhile lets just say that we are proud Adm@amp_01 contributed a whooping 19 entries.

Entries by Adm@amp_01

Additive Manufacturing start-ups

30. April 2020 in General /by Adm@amp_01Additive Manufacturing is a highly dynamic and innovative industry. This leads to start-ups that form the technology landscape. Emerging mostly from university background, start-ups are most active in area of system development. Other fields include software, materials and applications.

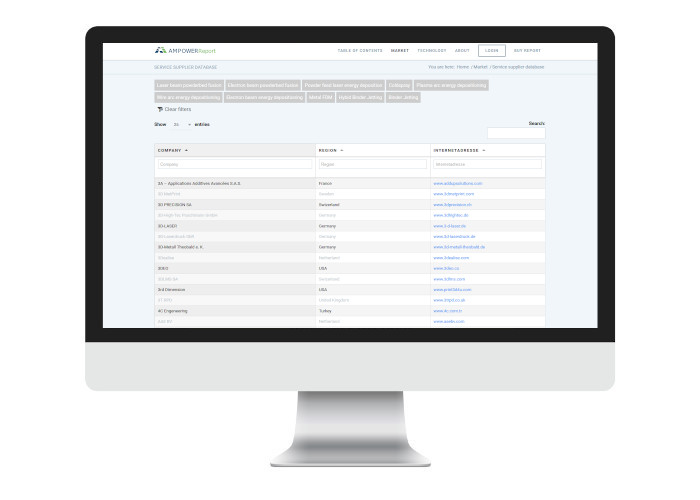

Metal AM Part Manufacturing Supplier

31. October 2019 in Database /by Adm@amp_01Additive Manufacturing part manufacturing supplier

External print capacity by manufacturing suppliers

Additive Manufacturing part manufacturing suppliers play an important role in the adoption of Additive Manufacturing. They lower the entry barrier for users by offering manufacturing services during the R&D and development phase. In a later stage they offer production capacities of additional alloys or economic alternatives for low volume end use parts.

You are not logged in or you do not have a subscription to the AMPOWER Report 2025.

To access the full report content please login or purchase a plan.

Click here for a market report summary.

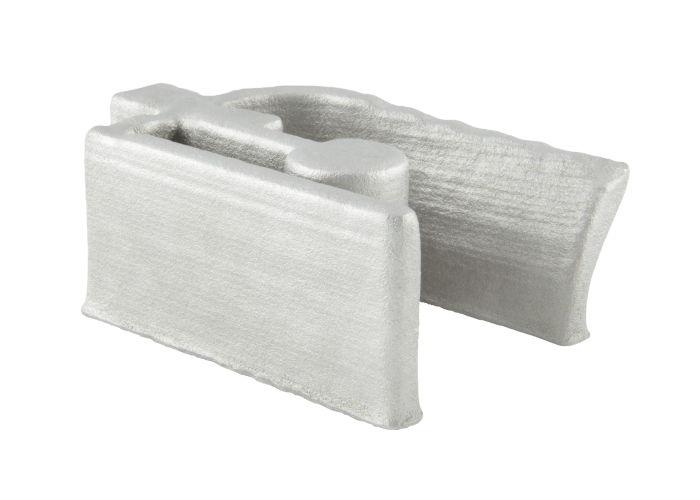

Coldspray

8. October 2019 in Metal, Technology /by Adm@amp_01Technology deep dive

Coldspray Additive Manufacturing

Coldspray is an Additive Manufacturing technology based on a traditional coating technology. Powder particles are bonded in solid state only by plastic deformation due to impact. This leads to extremely high productivity but the level of details and the data preparation are challenging.

What you will find in this report section

You are not logged in or you do not have a subscription to the AMPOWER Report 2023.

To access the full report content please login or purchase a plan.

Click here for a market report summary.

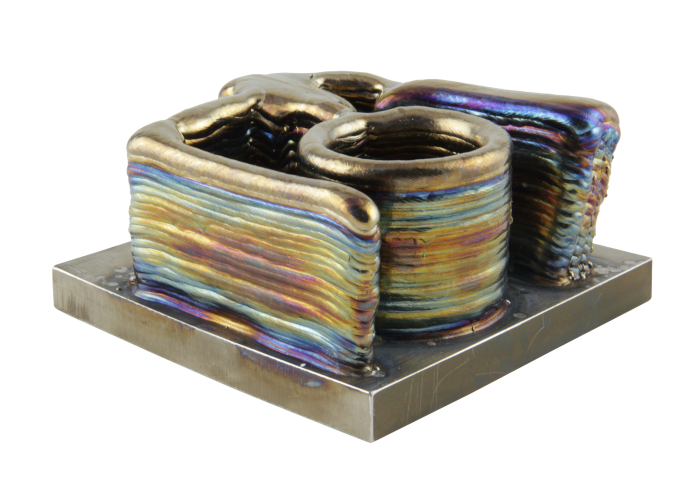

Wire Arc Deposition

7. October 2019 in Metal, Technology /by Adm@amp_01Technology deep dive

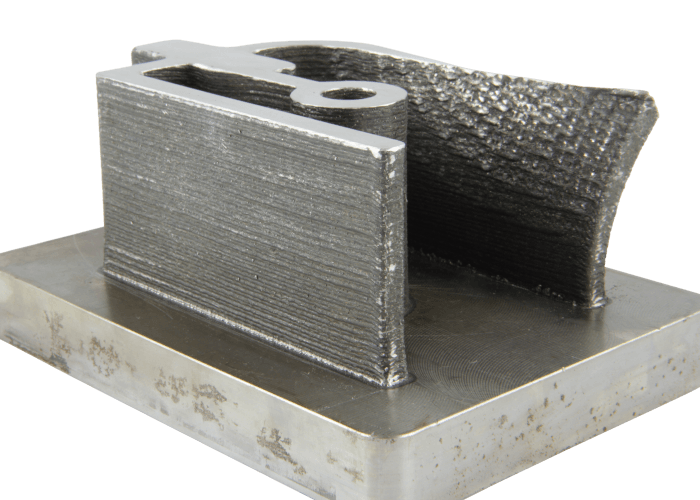

Wire Arc Deposition

Wire Arc Deposition, also known as Wire Arc Additive Manufacturing, is based on conventional wire based welding processes such as MIG, MAG and TIG welding. Due to its simplicity and low cost input material, the technology promises very high build rates at low cost. However, to achieve the full flexibility that Additive Manufacturing claims, further development efforts in data preparation are still necessary.

What you will find in this report section

You are not logged in or you do not have a subscription to the AMPOWER Report 2023.

To access the full report content please login or purchase a plan.

Click here for a market report summary.

Powder Laser Deposition

30. September 2019 in Metal, Technology /by Adm@amp_01Technology deep dive

Powder Laser Deposition

Powder Feed Laser Energy Deposition, also known as Laser Metal Deposition (LMD) is a welding technology used for many years. Recently the technology is adopted as an Additive Manufacturing technology by system integrators and off-the-shelf system providers. In this report section you learn about the background of LMD.

What you will find in this report section

You are not logged in or you do not have a subscription to the AMPOWER Report 2023.

To access the full report content please login or purchase a plan.

Click here for a market report summary.

Binder Jetting

29. September 2019 in Metal, Technology /by Adm@amp_01The patents for Binder Jetting are as old as the ones from laser beam powder bed fusion. However in recent years, the technology is getting more attention due to several new players in the field who claim, Binder Jetting might enable large volume metal Additive Manufacturing production. In this report section, you learn everything about the background and state of the art of this technology.

Additive Manufacturing Applications

18. June 2019 in Database /by Adm@amp_01Browse through sample applications for a wide range of metal Additive Manufacturing technologies, alloys and industries. See real use cases with industrial relevance that already entered production. Understand the background of Additive Manufacturing applications that generate added value for the user.

Metal AM System Suppliers

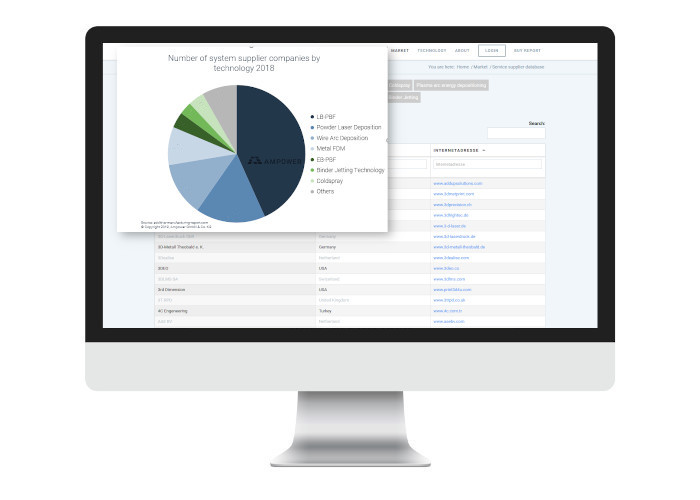

8. June 2019 in Database /by Adm@amp_01Additive Manufacturing system supplier

Supply chain for metal Additive Manufacturing machines

When it comes to metal Additive Manufacturing systems, there is a vast array of technologies available, with almost 20 different options to choose from. However, the majority of metal Additive Manufacturing systems on the market today use Laser Beam Powder Bed Fusion technology, which offers high accuracy and precision in the production of metal parts.

If you're interested in exploring the wide range of metal Additive Manufacturing system suppliers available, you can browse through our comprehensive database that includes information on suppliers from all around the world. This database provides not only the names of the suppliers, but also their home countries and the specific AM technology that they offer.

Whether you're looking for a supplier that specializes in a particular metal Additive Manufacturing technology, or simply want to explore the full range of options available, this database can be an invaluable resource. With detailed information on suppliers and their offerings, you can make informed decisions about which supplier is the right fit for your needs.

You are not logged in or you do not have a subscription to the AMPOWER Report 2025.

To access the full report content please login or purchase a plan.

Click here for a market report summary.