Download the free management summary of the AMPOWER Report 2025

Focused on 185 pages with over 80 figures and diagrams, the AMPOWER Report is the global standard for metal and polymer Additive Manufacturing market numbers and technology trends. The free summary contains the key take aways.

Preview on Management summary

AM market with challenging year and positive outlook

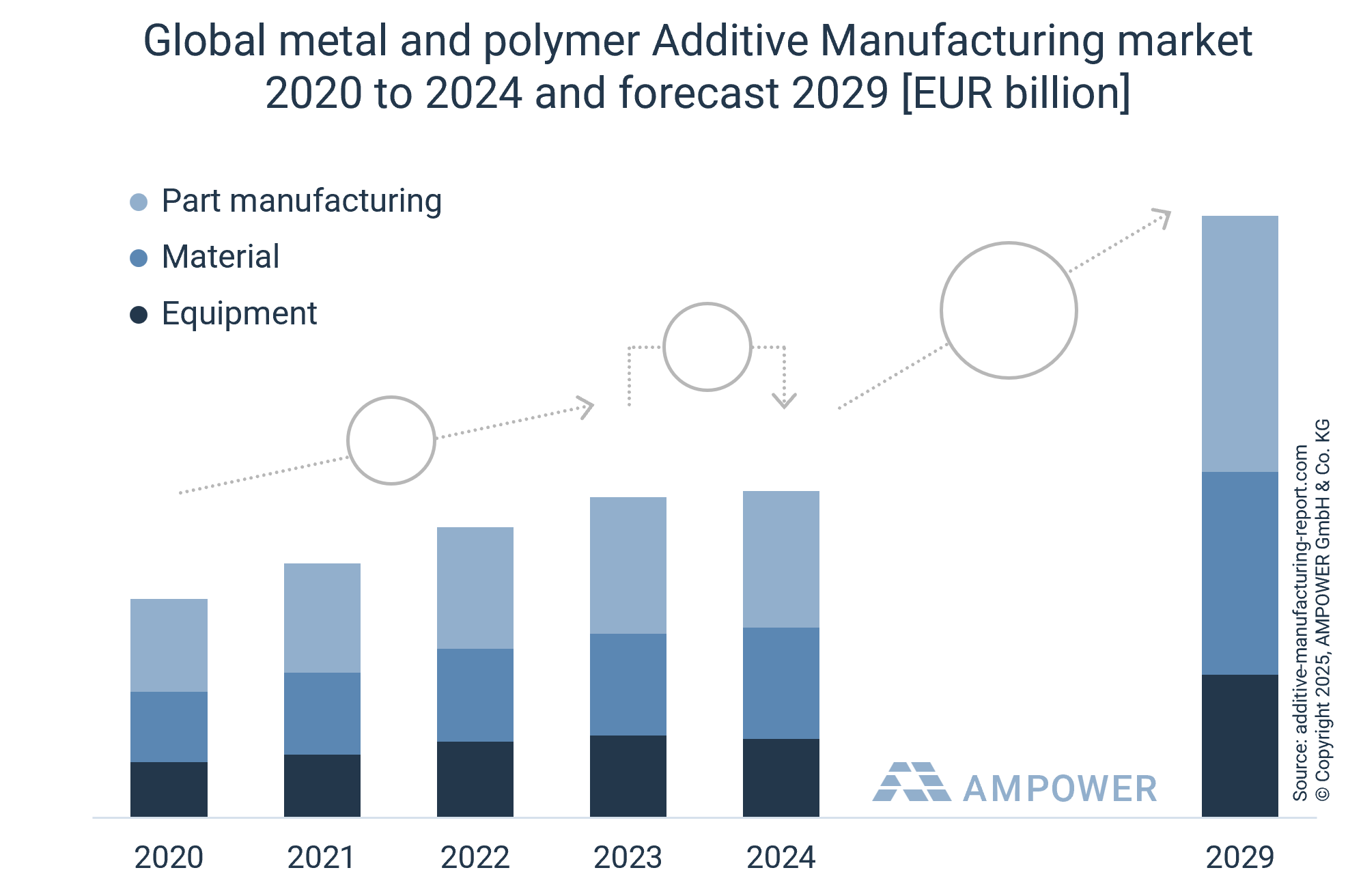

The overall Additive Manufacturing market including equipment, material and part manufacturing services for metal and polymer material is valued at over EUR 10 billion with a projected growth of CAGR 13% until 2029. The industrial polymer Additive Manufacturing market is about 2 times the size of its metal equivalent. While system sales revenues in both markets are at a similar level, material and part manufacturing services are much more developed for polymers resulting in a larger share of revenue. The AMPOWER Report segments each category into polymer and metal materials as well as into separate regions.

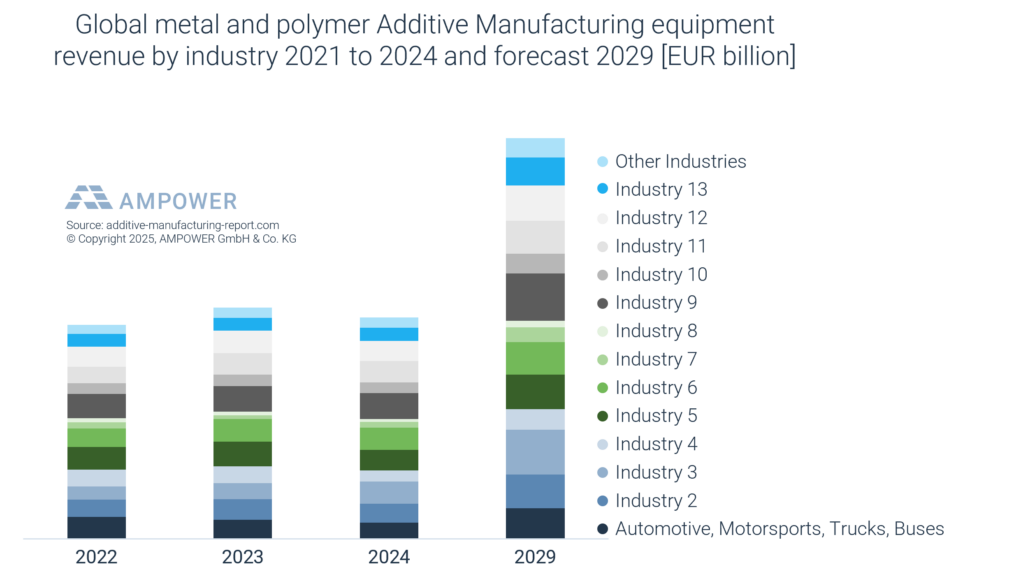

Aerospace and Defense industries are leading system sales revenue

Defense exibits strongest growth rates, especially in the US and China. Besides the Aerospace and Defense sector, the medical and dental industry was also among system suppliers’ prime customer. Dental aligners, hearing aids or bone replacement endoprosthesis are only a few examples of medical devices which are in production using metal and polymer Additive Manufacturing technologies. The advantages of AM in terms of flexibility, design freedom and mass-customization meet the demand in this sector especially well. A growing material range, improved software platforms to further facilitate customizations to patient data and many other factors will continue to push medical AM applications to further growth in the future. The AMPOWER Report segments equipment sales into 13 industrial verticals.

Further highlights of the management summary

Market share analysis

Nearly 500 equipment supplier for industrial Additive Manufacturing machines are globally active. In metal AM, the AMPOWER Report lists 260 companies, that offer industrial metal 3D Printing equipment. The dominant technology in this segment is Powder Bed Fusion with nearly 100 suppliers. The top 10 companies are uniting over 80% of market share.

Material volumes

While material sales growth has slowed, overall volumes have increased, indicating a general reduction in material costs. This trend has developed over the past years as more customers seek an independent and commoditized supply chain for materials. In the metal segment, high-value materials like titanium and nickel-based alloys continue to dominate the market.

Leading Applications in AM

Besides Automotive and Aerospace, Medical, is amon the leading industries in the market. The french company Artha for example created a lumbar belt to improve proprioception for visually impaired and blind people. This type of application can only be manufactured by Additive Manufacturing, in this case by Thermal Powder Bed fusion on HP machines. Courtesy of Artha.

Additive Manufacturing forecast

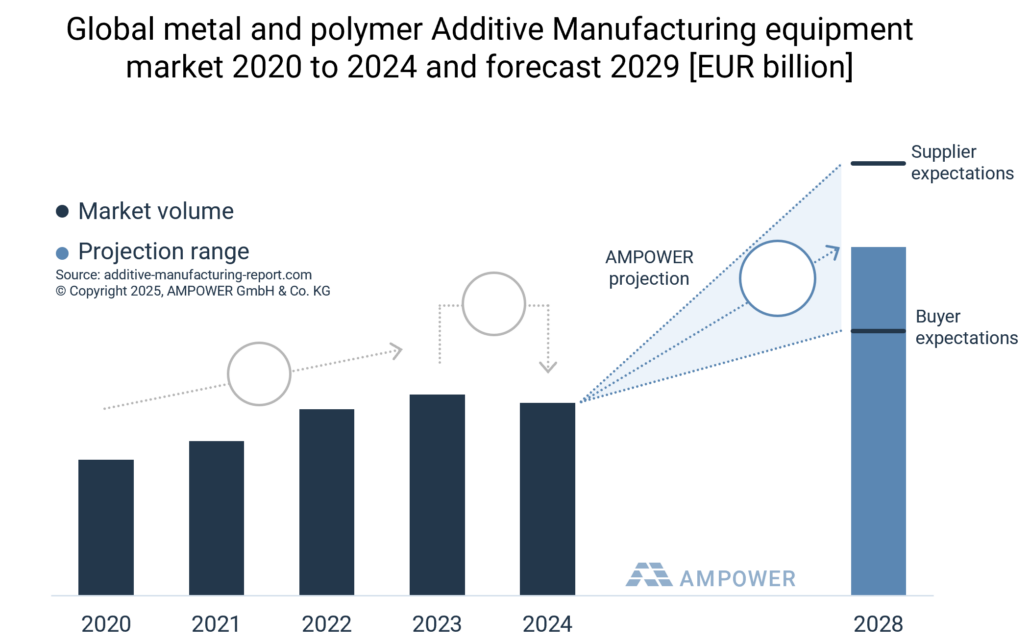

For the AMPOWER Report, suppliers of AM equipment as well as buyers were surveyed for their forecast predictions for the next 5 years. While suppliers traditionally have a more optimistic outlook, buyers tend to be more conservative in their predictions. The AMPOWER forecast for Additive Manufacturing is calculated taking both views into account.

Why AMPOWER Report

The full AMPOWER Report gives access to deep dive market analytics and databases

The authors combine over 50 years of experience in Additive Manufacturing as well as over 300 international customer projects and trained hundreds of engineers worldwide. The report is the first of its kind, that combines direct personal interviews with users and suppliers of the industry. The system suppliers that contributed direct input for the AMPOWER report represent over 90 % of the worldwide installed base of metal Additive Manufacturing machines.