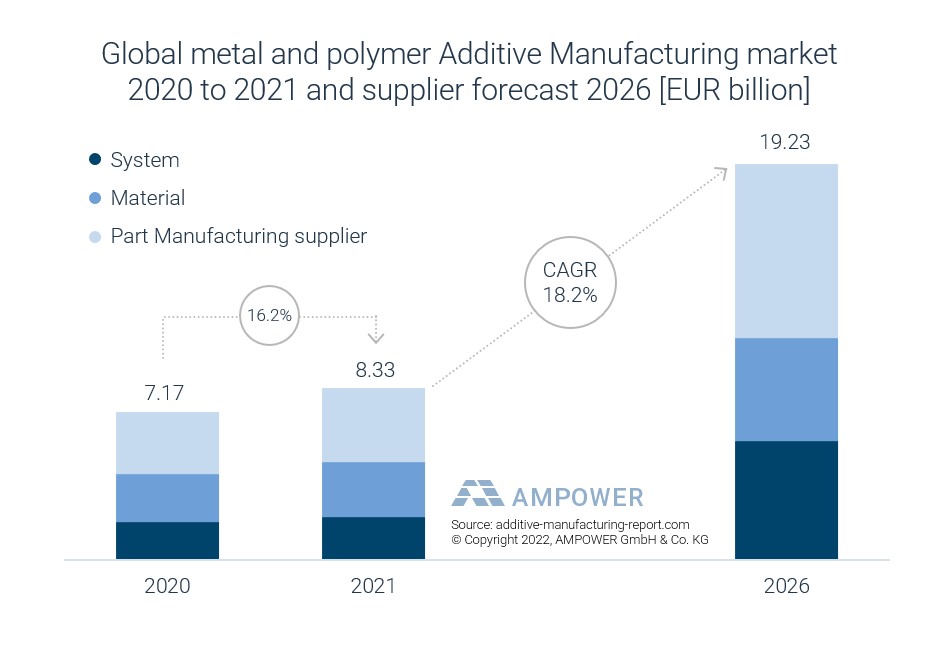

Additive Manufacturing market size predicted to grow at over 18 %

The overall Additive Manufacturing market for metal and polymer systems, material and part manufacturing services is valued at around EUR 8 billion in the past years with a projected growth of CAGR 18.2 % until 2026. The Additive Manufacturing market growth rate was significantly higher in the past with 25-30 %. However the technology lately experienced a certain maturity level within the high value part production markets while mass markes remain locked. The industrial polymer Additive Manufacturing market is much larger than its metal equivalent. While system sales revenues in both markets are at a similar level, material and part manufacturing suppliers are much more developed for polymers resulting in a larger share of revenue.

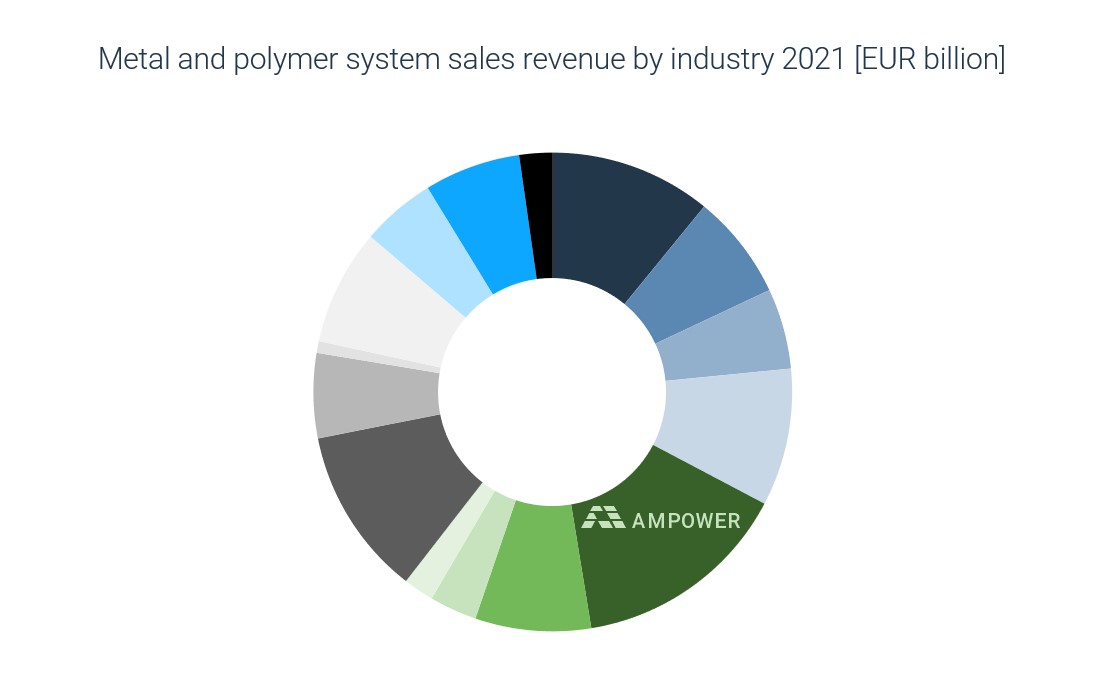

The aerospace, turbine and helicopter industry covered the largest share followed by the medical industry. The aerospace sector profited from multiple activities for new space applications such as rocket engines and therefore attracted large sums of venture capital especially in the US market. At the early days of metal Additive Manufacturing, Germany was the leading market region with its first movers in LB-PBF technology CONCEPT LASER (now GE), EOS, REALIZER (now DMG MORI) and SLM SOLUTIONS. Hence, many pioneering users were located in Germany and Europe. By now, however, the Additive Manufacturing market share is more evenly distributed with suppliers and buyers from all over the major industrial regions of EMEA, AMER and APAC.

Additive Manufacturing Market size by region

Strongest Additive Manufacturing market growth expected for AMER and APAC

In the past years the largest market for Additive Manufacturing market suppliers is EMEA region. Within the regional revenue of EMEA and AMER a majority is attributed to system sales. APAC region, on the other hand, shows an even larger share of system sales revenue. In the APAC region users are in an earlier state of adopting AM technology, typically characterized by machine acquisition. In EMEA and AMER activities are driven by industrializaton and scaling of production.

The forecast shows AMER will exhibit high growth rates to multiply today’s market size. APAC will follow in growth. EMEA region will continue to grow at high rates, but below the worldwide average. However, EMEA will continue to remain the strongest region in terms of market size for the outlook period.

Additive Manufacturing Market by technology

LB-PBF is the dominating technology in the Additive Manufacturing market

LB-PBF is the dominating technology in the Additive Manufacturing market. Since new AM technologies will be increasingly pushing into the market, the share of PBF is expected to decrease in the future. Over the past 5 years this share was even higher. In the next 5 years, system footprint of Binder Jetting and DED technologies such as Wire Arc Deposition and Powder Laser Deposition are expected to increase.

In the past years, the number of Metal FDM systems increased for the second year. It should be noted, that the cost for Metal FDM systems is usually not so high and therfore sets a lower investment barrier. Furthermore, many system suppliers have a large number of resellers in their respective distribution channels, which may have been obliged to purchase demonstration systems in 2019. These systems are included in the total number of sold machines, although they may not have been installed at an industrial customer, yet.

For the comming years, AMPOWER expects the Additive Manufacturing market to become more divers with new emerging technologies tha offer higher productivity and lower cost.

Additive Manufacturing market by industry

Aerospace sector leads in system sales

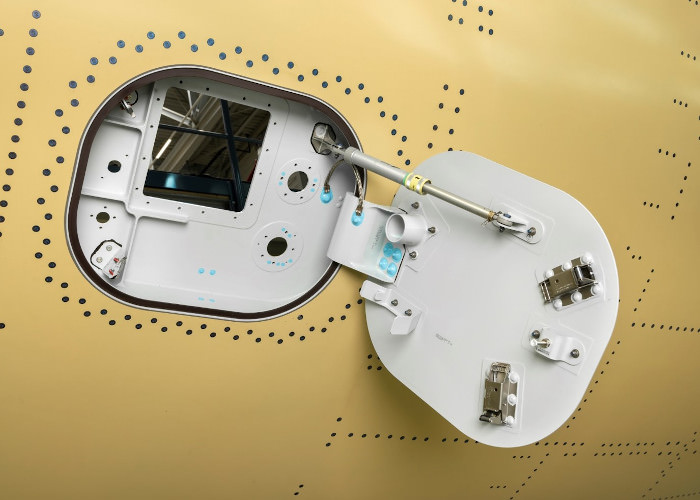

Various industries have successfully adopted AM. Medical and dental can be regarded as pioneering industry of the Additive Manufacturing market with first serial productions starting in the early 2000s. Other industries, especially aerospace caught up to medical and continue to play a strong role in metal Additive Manufacturing, especially in the US. The Additive Manufacturing market report clusters industry by categories of Aerospace including Turbines & Helicopters, Automotive, Trucks & Buses, Energy & Powerplants, Medical & Dental, Tooling & Molding, Mechanical Engineering, Oil & Gas and others.

Market by materials

Metal Additive Manufacturing material consumption grows with increasing degree of industrialization

The Additive Manufacturing market for materials is expected to increase massively in the comming years. Regardless of the high growth, the feedstock accounts for only a very small fraction of the worldwide material market. Most of the consumption in AM is driven by high end applications in aviation and medical. Thus, high strength and high temperature materials such as titanium and nickel based alloys are taking large shares. Most of the metal Additive Manufacturing market size for materials is driven by powder feedstock followed by wire materials.

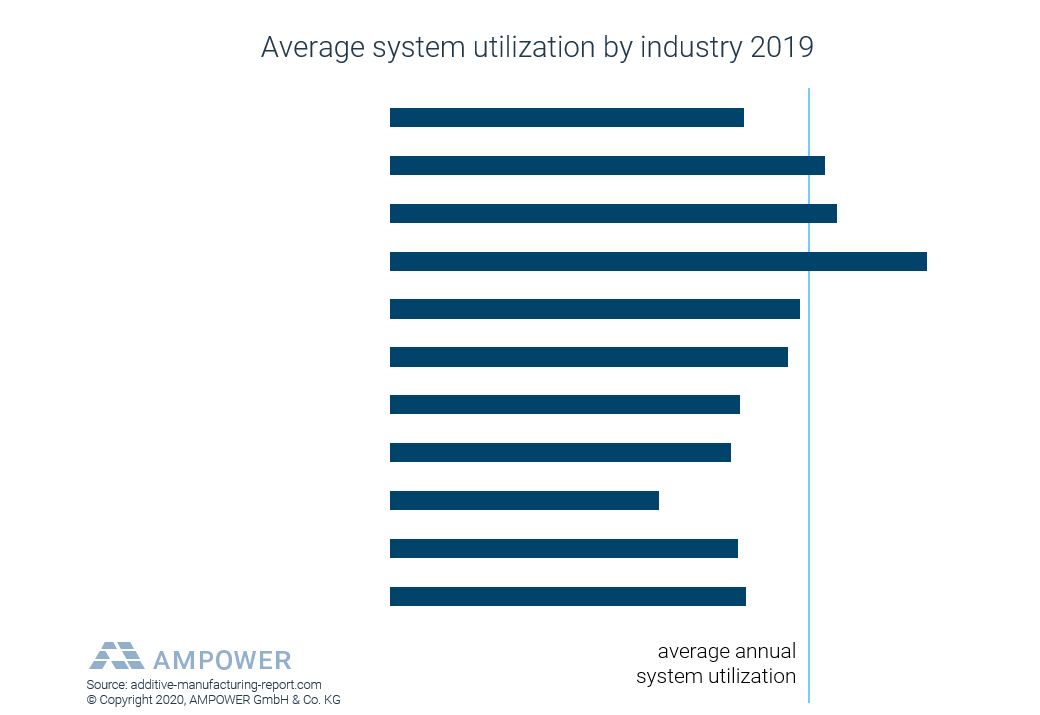

Industrialization

Most of the AM systems are not fully utilized

The average system utilization is an indicator of the degree of industrialization and the maturity of a technology in the Additive Manufacturing market. While high volume series productions such as in automotive can certainly achieve continuous run-time with minimized downtime for maintenance and repair, workshop environments usually run at lower utilization that comes with the flexibility of the production. Overall Additive Manufacturing is still mainly utilized for prototyping applications. Only few industries have adopted AM for a wide range of products and achieve near full-time production with the technology. However, the share of end parts in the Additive Manufacturing market environment is increasing every year.

Supply chain

Additive Manufacturing market dominated by system suppliers

Over the past decade the worldwide number of Additive Manufacturing system suppliers has increased significantly and a large variety of Additive Manufacturing technologies has emerged. Today, more than 500 metal and polymer AM system suppliers are known worldwide and listet in the AMPOWER Database accessible through the AMPOWER Report. Most of them are located in the USA, China and Germany. The USA are representing the largest number of system suppliers. The system suppliers dominate the Additive Manufacturing market with their technology developments.

Go to the system supplier database

Applications

Number of industrial applications continue to grow across all industries

Early movers of successful Additive Manufacturing applications have in common, that they originate from high end and high value component manufacturing. Typical examples are the medical, aviation, turbine, space and oil & gas industry. Parallel, the machine industry became aware of the one-off part production potential of metal Additive Manufacturing, too. Especially the tooling industry and special machinery in high-end segments are promoting the development of metal Additive Manufacturing applications.