Aim of the AMPOWER Report

Comprehensive, reliable and independent

Now in its 6th edition, AMPOWER publishes this annual market report since 2019 to provide the industry with an unbiased and realistic view on the actual Additive Manufacturing market developments.

Since decades the AM industry is flooded with marketing claims and bold promises to win customers and investors. AMPOWER developed this report with the goal to provide an accurate representation of the true market development within the industrial Additive Manufacturing sector. The AMPOWER Report uses primary data gathered in expert interviews, with suppliers and users alike, to generate its market analysis. The surveyed data is almost always not available publicly. In order to acquire such raw data, the interviewees trust AMPOWER that their data is treated confidential.

Data acquisition

Cover of the industrial AM market

Basis for the AMPOWER Report 2024 are personal interviews as well as secondary research from publicly available sources.

The personal interviews were conducted directly by AMPOWER staff. The respondents were typically the respective Additive Manufacturing managers or directors with insight into the technological as well as economical company figures. The total number of data points of the AMPOWER Report 2024 data acquisition exceeds 34,300. Additional historical data and qualitative information was used to describe the AM market most accurately.

The system suppliers that contributed with direct input represent more than 90 % of the worldwide installed base of metal and polymer Additive Manufacturing systems. Secondary sources such as indirect data sources, press releases, financial reports, etc. were used to provide coverage of the remaining installed machine base. The machine buyers, or users, that contributed direct input for the report represent 11 % and 3 % of the worldwide installed base of metal and polymer Additive Manufacturing systems, respectively

Analysis

Market report model

The AMPOWER Report 2024 is based on a methodology developed in 2018 for the first edition of the AMPOWER Report, which was solely focused on metal materials. It was continuously refined in the subsequent editions. The methodology considers the specific characteristics of Additive Manufacturing and its B2B market. For polymer materials, the model was adapted and revised to meet peculiarities for this specific market.

AMPOWER has limited the scope of the analysis on industrial machines and applications. The report therefore only considers industrial systems that are above the purchase price of EUR 10,000. Today, this is mainly relevant for the polymer market. AMPOWER defined this limit to separate the industrial market sufficiently from the personal B2C market.

Basis for the model is the full coverage of the system supplier market and the installed base of Additive Manufacturing machines.

The feedstock consumption and revenue are based on a model that takes into account the utilization of installed machines. It includes alterations for future feedstock prices and advances in machine productivity.

Period of interest

Past calendar year and forecast of five years

The time of interest for the AMPOWER Report 2024 is the calendar year of 2023 as well as the forecast period until 2028.

As with all forecasts, data for the period until 2028 are based on estimates, business plans and projections regarding activities in Additive Manufacturing by the respective respondent’s company. Projections are based on user and supplier expectations. AMPOWER did not add any correction factors that might account for changes due to past, current or expected geopolitical events or other causes. The market data of the AMPOWER Report 2024 is based on data acquisition performed at the end of the year 2023 and beginning of the year 2024.

Region of interest

Cover of major markets

The report has a worldwide region of interest and does not exclude any markets.

Currency

Exchange rates

The market data in this report is provided in the currency of euro (EUR). Data collected in other currencies is converted by the following exchange rates that depict the average exchange rates for the year of 2023 according to EUROPEAN CENTRAL BANK:

EUR 1.00 = CNY 7.67 = JPY 153.17 = USD 1.08

Respondents

Respondents reflect state of industry

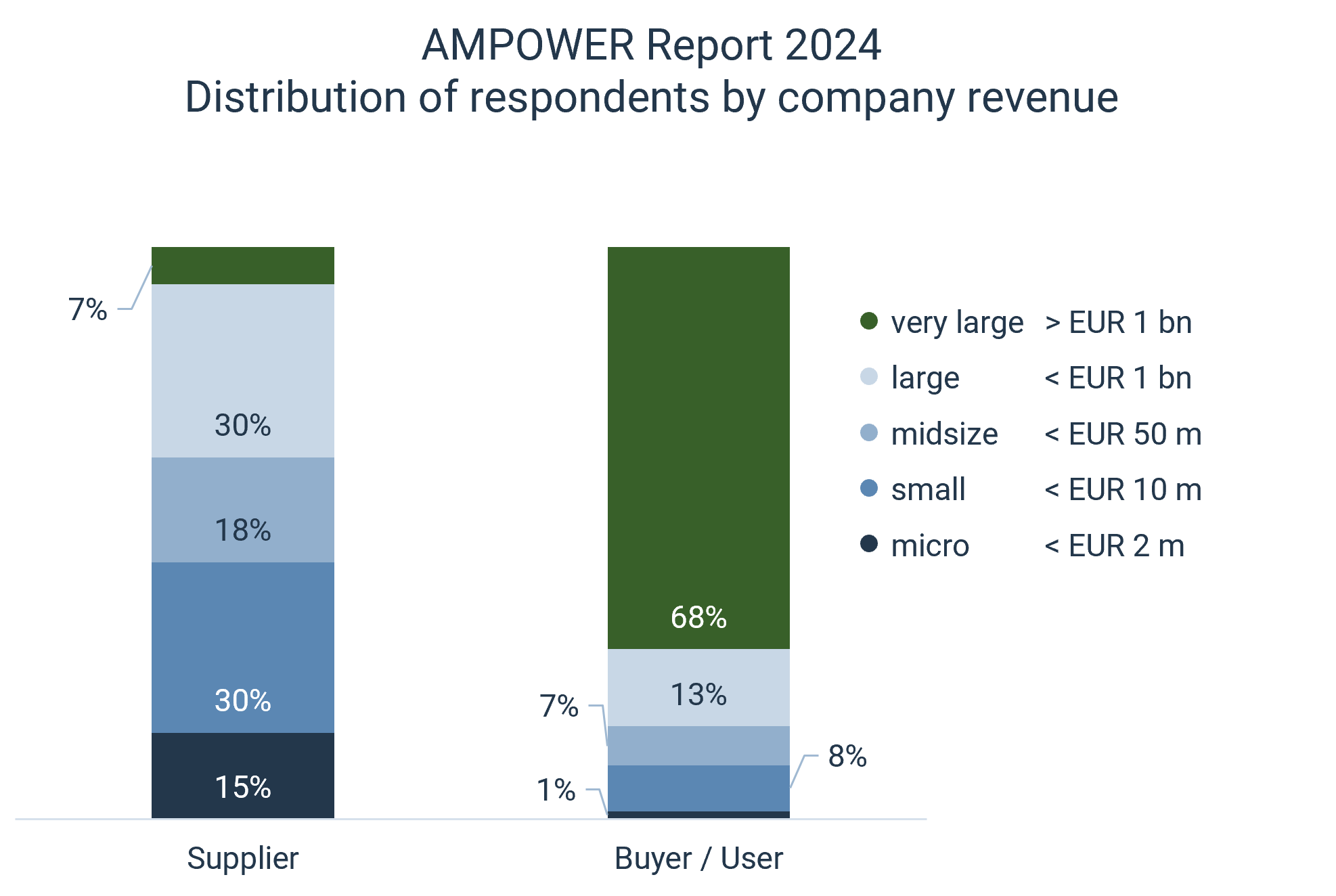

More than half of all respondents of the supply chain, i.e. system, material or part manufacturing suppliers are associated to companies with revenues below EUR 10 million.

Many companies in the supplier group are startups and therefore small in terms of revenue. Despite some entities having a high market valuation, they may not have introduced their products into the market or are still in a growth phase with high costs, resulting in low revenue.

The largest share of buyer or user respondents of the AMPOWER Report are very large companies with a revenue of over EUR 1 billion when combined by all affiliated companies. Additive manufacturing primarily operates as a B2B market, where components are rarely sold directly to individual customers. Instead, large companies use AM to produce components for larger machines, systems, or products, which provide functional and cost benefits.

The prevalence of large companies also reflects the capital-intensive nature of additive manufacturing technology. Successful in-house production requires a full process chain that includes not only the printer system but also design and simulation capabilities, periphery for post-processing and finishing, as well as engineering capacity.

The polymer AM supplier landscape is divided into a B2B and B2C market. Many part manufacturing suppliers have established separate entities or organizational structures to provide services and products to both industrial and individual customers. However, the AMPOWER Report 2024 only covers industrial AM activities and excludes system sales below EUR 10,000 and materials that target individual consumers.

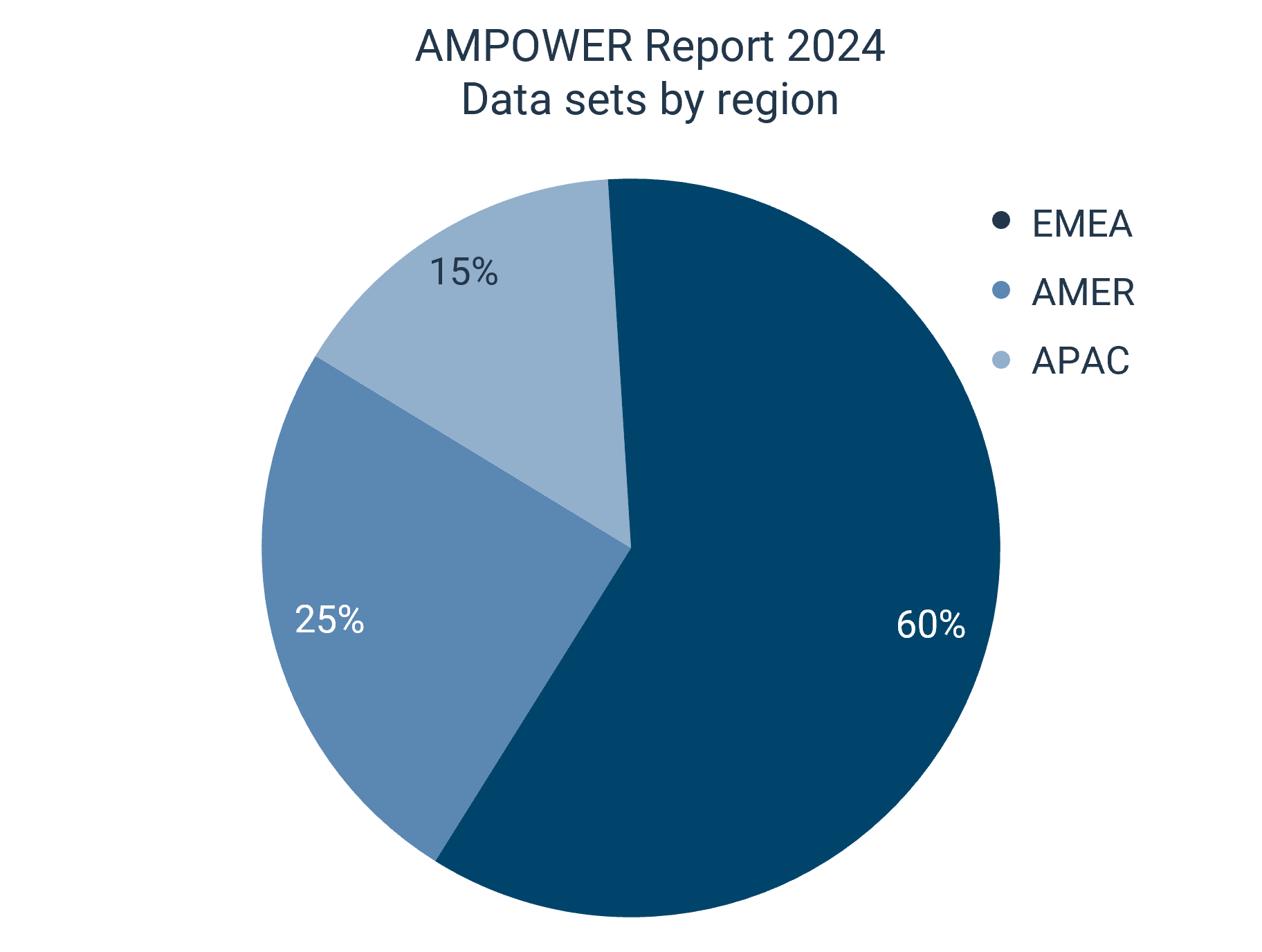

The majority of respondents of the AMPOWER Report 2024 are from EMEA region, particularly the EU, comprising 60 % of the total. The respondents of the Americas (AMER) and the Asia Pacific region (APAC), consisting of East Asia, South Asia, Southeast Asia, and Oceania, account for 25 % and 15 %, respectively. Respondents come from 32 different countries in total.

Market player categorization

Suppliers and buyers

The AMPOWER Report classifies market players into two categories: suppliers and buyers. The supplier group is further divided into equipment, material, and part manufacturing suppliers. Equipment suppliers are evaluated based on machine sales and additional services like maintenance and application development.

The material supplier group includes feedstock sales. The report data on feedstock consumption results from a model that is based on the operation of installed user machines.

The group of part manufacturing suppliers comprises entities that provide AM production services to customers across various industries. Entities that almost exclusively provide products to one industry, such as an aviation Tier 1 supplier, are defined as users or buyers within that respective industry.

Secondary goods and services in the AM process chain are excluded from the service supplier group and not tracked in this report. This includes for example general machining or post processing of AM parts, sales of periphery, e.g. shot blasting cabinets, as well as software, such as CAD or preprocessing tools.

The group of buyers, also referred to as customers, are users of Additive Manufacturing technology who purchase equipment, feedstock or services from part manufacturing suppliers or other entities to produce and provide goods for their customers. These buyers are companies that are known to use AM technology or have announced plans to do so in the future. For companies that will become buyers in the future, the report includes projections for unknown entities and volumes.

Industry-specific Tier suppliers that deliver goods primarily or exclusively to a single vertical are also considered users and not part manufacturing suppliers.

Segmentations

Regions

To display the specific regional developments in the Additive Manufacturing market, the data is split into three regions:

- AMER: North and South America

- APAC: Asia Pacific region including Oceania

- EMEA: Europe, Africa and Middle East

Additionally, selected information is provided country specific.

Industry

The industries are segmented according to the major users of Additive Manufacturing technology. Depending on the available data granularity, the segmentation is altered and used in condensed form. Activities of part manufacturing suppliers are clustered according to the industry of their specific end customers. The group of Other includes all industries that interviewees could not allocate to the provided options.

- Automotive, Motorsports, Trucks, Buses

- Civil Aviation, Turbines, Helicopters

- Defense

- Space

- Medical

- Dental

- Energy, Powerplants

- Oil and Gas

- Industrial

- Tooling, Molding

- Naval and Rail

- High Tech (Electronics) (Polymer only)

- Research Institutions

- Part Manufacturing Supplier

- Consumer Goods

- Other

Segmentations specific for METAL

Technology

The AMPOWER Report clusters the metal Additive Manufacturing technologies into the groups of Powder Bed Fusion (PBF), Powder and Wire Laser and Electron Beam Energy Deposition (LB-/EB DED), Wire Electric and Plasma Arc Energy Deposition (Arc DED), Metal Material Extrusion (ME), Binder Jetting Technology (BJT) and Other.

For DED technologies, AMPOWER only tracks turnkey and off-the-shelf solutions. Customized systems assembled from individual components, such as welding heads and robots, are not included in the estimations. The system sales for metal Material Extrusion do only track industrial-grade machines and neglect low-cost 3D filament printers. The segment of Others includes technologies, such as Cold Spray or Friction Energy Deposition, that have a limited market volume today.

Material

The report segments metal feedstock according to the major alloys used in Additive Manufacturing. The material group of Other includes the rest of the materials and alloys, such as tungsten, carbides or precious metals, to name a few.

- Aluminum Alloys

- Stainless Steel Alloys

- Low alloy steel (since Report 2024)

- Tool Steel Alloys

- Nickel-base Alloys

- Titanium Alloys

- Cobalt Chrome Alloys

- Copper/ Bronze Alloys

- Other

Segmentations specfic for POLYMER

Technology

Polymer Additive technologies are clustered into seven groups. The group Powder Bed Fusion includes the technologies of Laser Powder Bed Fusion (trademark SLS) and Thermal Powder Bed Fusion (trademark MJF, HSS). Material Extrusion is differentiated by feedstock of filament and pellets. More technology groups are Area-wise Vat Polymerization (DLP), Vat Polymerization (SLA) and Material Jetting. Uncategorized technologies fall into the group of Other.

Technologies that currently have only one major contender, such as Electron Beam PBF are grouped together with related technologies in order to avoid revealing company specific details.

The uncertainty in market predictions is generally higher for technologies that are in an early market stage with small numbers of overall installed systems or in a fast-growing early market phase. Applications and solutions have yet to be developed by an unknown user group with unknown demand.

Material

The report segments polymer material according to the major polymers used in industrial Additive Manufacturing. The material group of Other includes the rest of available materials.

- ABS

- PA6

- PA11

- PA12

- PP

- PLA

- PET, PETG

- PEEK, PEKK

- ULTEM, PEI

- TPU, TPE

- PC

- Photopolymer (Dental and medical)

- Photopolymer (Industrial)

- Other