Managing Partner, AM VENTURES

Why market data is important

The AMPOWER 3D Printing Report

The 3D Printing report from AMPOWER shows a strong growth with a CAGR between 10-15 % in the past. However in 2024, the growth slowed down to around 2%. The 3D Printing market volume is segmented in metal and polymer technologies. The 3D Printing report is based on over 40 thousand data points collected by the AMPOWER Team every year. In this article, we introduce the AMPOWER 3D Printing Report and the methodology of the AMPOWER 3D Printing market analysis.

The AMPOWER 3D Printing Report provides valuable insights for companies in the 3D printing industry. It offers detailed information on market trends, technology developments, and material innovations. By analyzing the data provided in the report, companies can make informed decisions about their business strategies, such as which regions to target, which technologies to invest in, and which materials to use. The report also allows companies to benchmark their performance against competitors and identify areas for improvement. Overall, the “3D Printing Report” is an essential tool for any company operating in the 3D printing industry, providing a comprehensive view of the market and helping companies stay ahead of the curve.

3D Printing market size by technology

According to the AMPOWER 3D Printing Report, the 3D printing industry is dominated by more than 30 different technologies. The market is segmented into six major metal technologies and seven polymer technologies. Powder Bed Fusion is currently the most widely used metal technology, followed by Binder Jetting, Metal Filament Fabrication, Arc Welding and Wire Arc Additive Manufacturing, and Powder DED technologies. Fused Filament Fabrication is the primary technology used in polymer machine sales, while Powder Bed Fusion technologies generate the most revenue in the polymer 3D printing market. The AMPOWER Report further divides the market into Pellet Material Extrusion, Vat Polymerization, Area-wise Vat Polymerization, and Material Jetting.

3D Printing market by industry

The medical industry used to dominate the 3D printing market in both metal and polymer technologies. However in recent years, the defense segment showed strongest growth rates. Along with aerospace, automotive and industrial, these five segments account for over 50% of system sales revenues. The AMPOWER 3D printing report segments the industry verticals into the automotive sector, civil aviation, defence, space, medical, dental, energy, oil and gas, industrial, consumer goods, academia and others.

References

What our customers say

Managing Partner, AM VENTURES

The material segmentation of the 3D Printing Report

New materials are driving the development of new applications in the 3D printing market, and almost every week, suppliers announce new materials in both the metal and polymer markets. The AMPOWER Report segments the market into eight different metal alloys and 15 polymer materials.

In the metal market, the most dominant material is the titanium alloy group, and specifically the Ti-6Al-4V alloy, which is widely used in a range of medical, space, and aviation applications. Cobalt and nickel-based alloys also play a major role in similar industries, with nickel being used in many turbine applications where high temperatures demand IN718 or IN625 type alloys. The report also segments into stainless steel and tool steel alloys, and copper alloys are gaining market share. Aluminum alloys can be found in many automotive and industrial applications.

In the polymer market, PA12 materials dominate the 3D printing market, covering over one-third of global material consumption. TPU and PA6 are also rapidly growing thermoplastic materials. The report also mentions other materials with specific consumption values, such as PA11, ABS, PP, PLA, PET, PETG, PEEK, PEKK, ULTEM, PEI, and PC. The liquid resin 3D printing market is segmented by the type of resin, with medical and dental grade resins making up the largest share. The other two segments mentioned in the report are industrial and prototype resins.

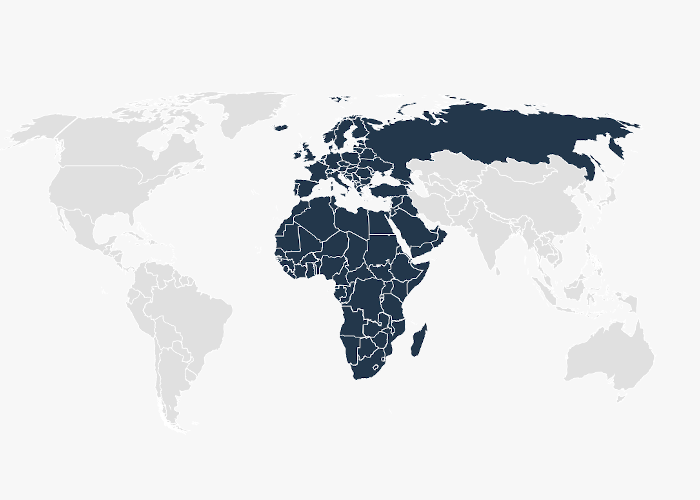

3D Printing market size by region

The AMPOWER 3D Printing Report provides a basic regional breakdown into three regions: AMER, EMEA, and APAC. However, in many graphs, these regions are further segmented to include specific countries such as China, western Europe, and the US. Despite having similar-sized markets, historically EMEA, particularly Europe and Germany, have been strong in metal 3D printing technologies, with leading suppliers such as EOS, SLM SOLUTIONS, CONCEPT LASER GE ADDITIVE, or TRUMPF being based there. As a result, the European market has traditionally had a high footprint of metal 3D printing systems. However, in recent years, the US has shown strong growth in the metal 3D printing market especially driven by aerospace and defense.

In contrast, the Polymer 3D Printing Market was initially dominated by VAT technologies developed in the US, making the US an early adopter of this technology. Additionally, many Material Extrusion companies today are based in the US, while some European companies have a strong presence in Powder Bed Fusion. The APAC market is dominated by China, although the AMPOWER 3D Printing Report also segments east asia and southeast asia. However, the Chinese market is primarily growing with domestic customers and has a relatively small presence outside of the APAC region or even outside of China. This development is changing though as the domestic market experiences a saturation and OEM are aiming for growth overseas.

The AMPOWER 3D Printing Report provides information on the installed base and system origin of all major technology groups in each region. Additionally, the database of the report allows for screening of all known suppliers of systems, materials, and part manufacturing services in both metal and polymer 3D printing.

The Key Features of the AMPOWER 3D Printing Report

The 3D Printing Report by AMPOWER is renewed in January and February and published in March each year. The report is completely independent and is based on directly collected data from suppliers and users of the industry. The basis for all data is the installed base and the newly sold machines each year. An emphasis of the report is on the forecast especially based on user predictions. The 3D Printing Market is dominated by innovative industrial users, who give AMPOWER Insights into their production roadmap and 3D Printing strategy.

Besides market numbers, the AMPOWER 3D Printing Report features deep dives into each metal and polymer 3D Printing technology. An annual maturity assessment of each technology gives an overview of how advanced technologies are and how widely they are used by companies. The Report also features a database with over 4,000 entries featuring all known suppliers of 3D Printing technology. Another key feature of the 3D Printing Report is the application database with over 200 real applications. The emphasis of the database is on real end applications which exceeded the level of “just showcases” and made it into production.

Collecting the annual 3D Printing Report data

The AMPOWER 3D Printing Report is based on direct interviews with supplier and user of the industry. In the first two months of each year, AMPOWER is conducting interviews with mainly system supplier, part manufacturing supplier, material supplier and user. In those interviews, the AMPOWER team collects data about newly sold or installed systems, regional, industrial and technology segmentations, outlook and company growth rates. User and part manufacturing suppliers also give insights into their machine utilization of the past years and the material consumption. The 3D Printing Market player trust AMPOWER with that delicate information because none of the data is being directly published. This means, AMPOWER does not publish for example sales numbers of specific vendors or installed bases of specific users. All data of the AMPOWER 3D Printing Report is aggregated and analyzed. This however means, that AMPOWER has to aggregate some of the information. For example, ARCAM, a company of COLIBRIUM ADDITIVE, was for a long time the only vendor of Electron Beam Powder Bed Fusion (EBM) systems. To avoid publishing direct sales numbers, the EBM system sales were aggregated under the category Powder Bed Fusion together with the much larger 3D Printing Market of Laser Beam Powder Bed Fusion. This might change however in the near future since several new vendors emerged on the market in the past years.

Why AMPOWER Report

Good reasons for the AMPOWER Report

The authors combine over 50 years of experience in Metal Additive Manufacturing as well as over 300 international customer projects and trained hundreds of engineers worldwide. The report is the first of its kind, that combines direct personal interviews with users and suppliers of the industry. The system suppliers that contributed direct input for the AMPOWER report represent 90 % of the worldwide installed base of metal Additive Manufacturing machines. The users, who contributed direct input for the report, represent over 10 % of the worldwide installed base.

Methodology of the 3D Printing Report

The AMPOWER team directly conducted personal interviews with respondents who were typically the managers or directors of 3D Printing with insight into both the technological and economic aspects of their companies. In total, the AMPOWER 3D Printing Report collected over 44,000 data points, and additional historical data and qualitative information was used to provide the most accurate description of the 3D Printing Market.

Direct input was received from system suppliers who represent more than 90% of the global installed base of metal and polymer 3D Printing systems. Secondary sources, such as indirect data sources, press releases, and financial reports, were used to cover the remaining installed 3D Printing machine base. The machine buyers or users who provided input represented over 10% of the global installed base of metal and polymer 3D Printing systems, respectively.

More than half of the supply chain respondents were associated with companies with revenues below EUR 10 million. Many of these supplier group companies are startups, and therefore small and micro in terms of revenue. Although the market valuation of some of these entities might exceed the perceived company category, their revenue is still low due to high costs and being in the growth phase.

The majority of buyer or user respondents were from very large companies with revenues above EUR 1 billion. Industrial 3D Printing is mainly a B2B market, where components are hardly sold directly to private customers. Large companies use 3D Printing to produce components for larger machines, systems, or products that provide functional and ultimately cost benefits. The share of large companies also reflects the capital-intensive nature of 3D Printing technology, where a full process chain is required for successful in-house production, including printer systems, design and simulation capabilities, post-processing and finishing periphery, and engineering capacity.

The polymer 3D Printing supplier landscape is divided into a B2B and B2C market. Many part manufacturing suppliers have established separate entities or organizational structures to provide their services and products to both industrial and private customers. The AMPOWER 3D Printing Report only covers industrial 3D Printing activities, neglecting system sales below EUR 10,000, and materials clearly targeted at private consumers.

![g25_Global metal and polymer Additive Manufacturing equipment revenue by industry 2022 to 2024 and forecast 2029 [EUR billion]DUMMY](https://additive-manufacturing-report.com/wp-content/uploads/2025/03/g25_Global-metal-and-polymer-Additive-Manufacturing-equipment-revenue-by-industry-2022-to-2024-and-forecast-2029-EUR-billionDUMMY-1030x637.png)