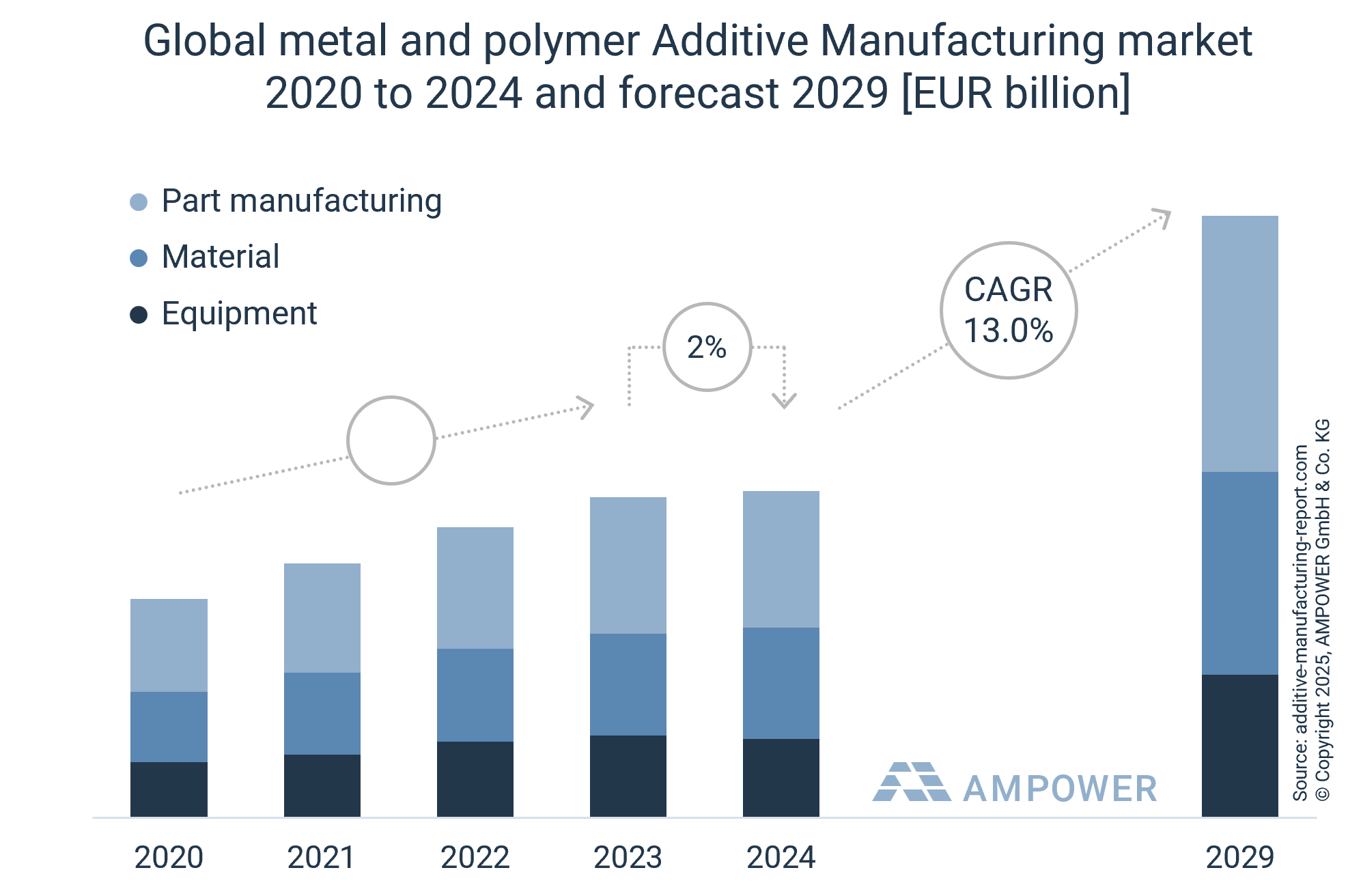

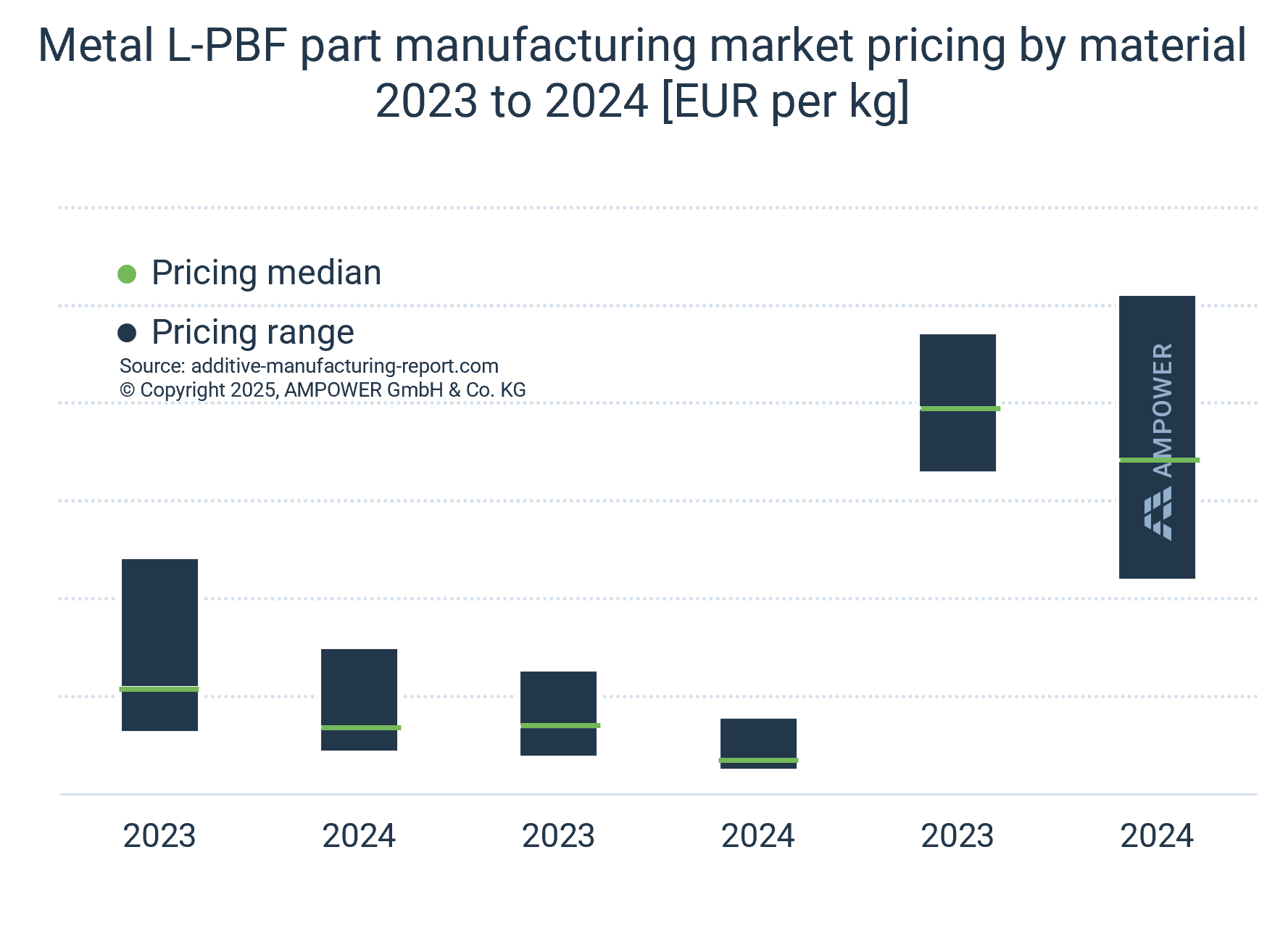

Metal and polmyer part manufacturing market pricing 2024

Metal part prices decline, while polymer sees slight rise

Based on an assessment of instant quotes from global online marketplaces, AMPOWER analyzes the part manufacturing market pricing developments each year for six major AM technology and material pairings.

Pricing requests are made for different part geometries and order volumes. The data reveals a significant price reduction for orders of up to around 100 parts. For standard applications, the price continues to decrease until the order volume surpasses 1,000 parts, where it reaches its lowest point.

Previous analyses have shown that at these dimensions, additional pricing factors typically associated with very small or very large parts, such as extra handling costs, are minimized. For the analysis, no additional post-processing treatments have been requested, except for the removal of supports and excess powder. Additionally, the pricing excludes shipment fees, taxes, or currency exchange costs.

The analysis includes six different technology-material combinations that are most commonly offered on international online quoting portals.

In the polymer segment, the analysis focuses on three different technologies.

The data is sourced from over 120 online quoting portals with instant ordering functions. These portals represent part manufacturing suppliers located in over 30 countries.